Article

8 min read

Three shades of large company integration - Pitfalls of the best-of-breed approach

In the past 5 years, significant acquisitions and mergers took place in the telecom and banking sectors in Hungary. In the telecom sector, all major companies have been involved in acquisitions, while the public market has now become a three-player market. In the banking sector, there has been a partial portfolio swap in the region, with banks exiting markets that did not offer them economies of scale and looking for new acquisition targets in the region instead.

Subsequent to the acquisition of Telenor in 2018, the merger of Vodafone and UPC in Hungary opened the way for Vodafone to become an integrated fixed-mobile operator. 2021 saw the start of 4iG's acquisition spree in the telecom market, narrowing the public telecom market down to 3 players. In the banking sector, it has become common practice for the largest domestic bank to continuously acquire other banks, mainly in the region and to the east of Hungary. Examples of regional portfolio swaps are Raiffeisen - Poland, Slovenia vs. Czech Republic, or OTP - Slovakia vs. Slovenia. Acquisition merger transactions starting in 2020 created Hungarian Bankholding Ltd., the bank with the second-largest balance sheet total in the market.

Acquisitions can be aimed at improving cost efficiency or increasing market share, but also at acquiring a new capability or brand. Once the acquisition deal is closed, the integration process starts, transforming business operations, functions and processes. It also entails the consolidation, and in some cases significant upgrade, of the IT and telecom network architectures.

What style of integration should we impose? Acquisition targets do not clearly define the integration pattern to be followed. Each case must therefore be examined individually and analysed to determine the best way to integrate.

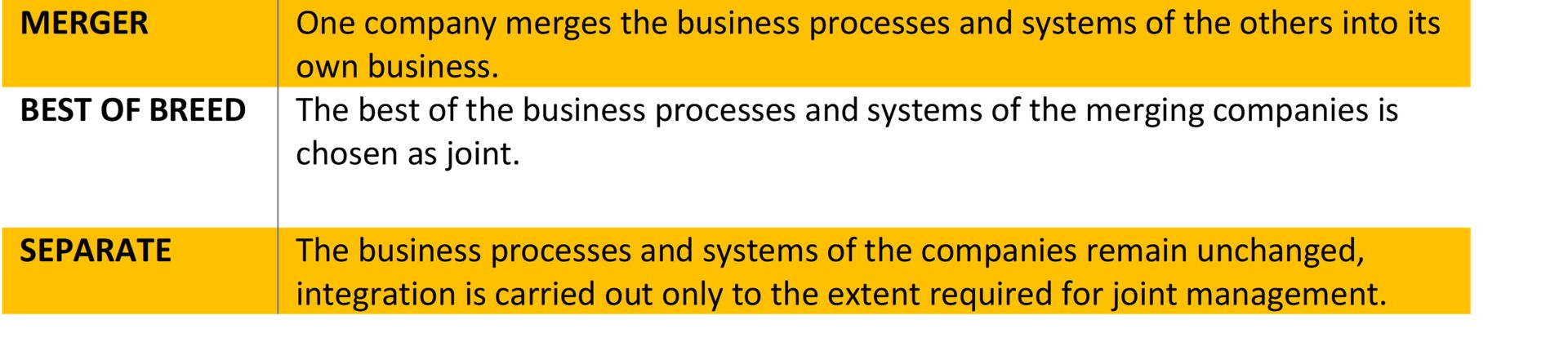

TYPICAL "STYLES" OF INTEGRATION

Mergers are common when there is a large difference in size between companies, so it is cheaper and faster to integrate the smaller company. But even then, some operational elements may be absorbed and adopted by the larger company, especially if the smaller company has operational advantages that are worth exploiting.

Integration maintaining separate entities is perhaps easiest to choose if the markets are well separated and there are no apparent synergies from merging them, or if new acquisitions or divestitures are expected in the near future. Groups with specialised knowledge, technology orientation, or innovative culture can be destroyed by rapid integration, in which case separation is again preferable.

Is best-of-breed good in all other cases?

Not necessarily, because we need to do an analysis first before we do anything else. Based on the outcome of the analysis, we may eventually decide to merge.

The best-of-breed style requires the assessment of the existing architecture, and a comparative analysis at domain or system level. The functional capability match of the systems with the merger's objective of future business operations should be assessed. The system and infrastructure architecture should be checked for modernity, modularity, integrability, development, and operational costs. If gaps are found in the match with the merger's objective - the future operating model and processes -, their elimination and the integration of systems will involve development tasks and upgrades. The larger the pieces of the target architecture, the less integration will be required.

Should we upgrade? An integration project offers a tempting opportunity to replace existing, often outdated applications, infrastructure, or network element. When there is a benefit that aligns or harmonises with the merger objective, it is advisable to extend the analysis to cover it.

Is all information available?

When evaluating systems, the degree of documentation should also be assessed. In most cases, the documentation of processes, products, systems, infrastructures is mostly incomplete. The information is stored in collective knowledge or rests with suppliers. In such cases, it takes considerably longer to prepare plans and requirements, and orchestrate the actual implementation.

Available information is limited and it is not always possible to prepare the analysis of systems to the same depth. Business operation is not yet a process fully understood at this stage either.

It is advisable to first formulate a hypothesis about the target architecture and then record the supporting assumptions. These conjectures can be validated by additional analysis; at least those that suggest to modify our assumptions, or cause variance in costs or implementation time. Our assumptions can be addressed to business or strategic participants, other projects included in the fusion project, or a simultaneously running business project can also yield information that may be relevant and necessitate the adjustment of our assumptions.

The analyses carried out may be biased or distorted by the views of the experts and specialists participating in the merger; it is therefore advisable to grant the assignment to an experienced, credible external consultant.

Do we need a new greenfield scheme?

The conflicts of interest within a fusion or merger, and the pending maintenance of existing systems are often a good common denominator in the choice of a new system. If the creation of a completely new business operation is derived from the merger objective in the area supported by the system, it is likely to be a good choice. If we don't perceive such, then it's worth consulting suppliers in view of a deeper analysis prior to further encumbering the integration project with the risks of greenfield implementation.

Achieving the target architecture can be achieved in several steps. It should be a well-thought-out choice to decide to what extent the intermediate architectures are viable, or how much extra workload they delegate to our clients or users. Will the expected benefits be evenly distributed over time or can they be realised at the very end and not before?

Is there a need for an external consultant?

Many questions need to be resolved at the same time, business and IT questions together need simultaneous business and IT answers. Consultants often rely on fewer assumptions than the internal organisation and tend to present a more objective picture. The internal organisation can give an erroneous estimate when assessing synergies, costs and risks, as it does not have enough comparative information and can be influenced by corporate interests.

Stratis Ltd. is the largest Hungarian-owned independent management consultancy firm with more than 20 years of experience and revenue exceeding HUF 3 billion.

We have proven key competencies in the due diligence, valuation, risk/hazard analysis, integration and consolidation project planning & design, execution, and IT strategy development of companies in the banking, telecommunications, and energy sectors.

In the energy sector, we participated full scale in a merger, helping to split one company and integrate the resulting parts into two others. In the banking and telecom sectors, our activities have included merger planning, due diligence, carve-out, and integration projects.

We have the consulting competencies required for data cleansing and migration, and our Analytics business enables us to implement them in practice. We have done so in both the telecom and banking sectors.

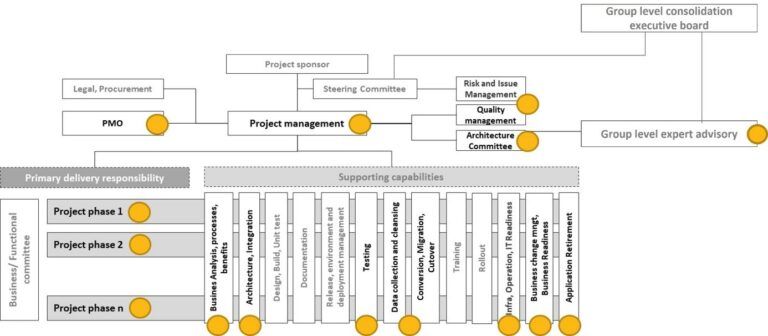

STRATIS CAPABILITIES IN PROJECTS RUNNING IN "INITIAL INTEGRATION", "MAIN INTEGRATION" OR "BENEFITS REALISATION” PHASES

About author

László has been working in IT management for 17 years. In the past years he has worked in the evaluation of acquisitions and IT integrations. He has been involved in the consolidation and replacement of telecommunications and banking core systems. His experience as an IT manager, consultant and quality assurance manager has been used in the preparation of this study.