Article

12 min read

How is it made? Post-acquisition IT integration tasks

In the telecommunications and banking sectors, significant acquisitions and mergers were concluded in Hungary in 2021-2022. The acquisition of small cable TV operators had already been completed in the mid-2010s, and anticipated market targets shifted towards larger service providers. The acquisition of Telenor in 2018 did not reduce the number of players in the market. The fusion of Vodafone and UPC in Hungary cleared the path for Vodafone to become an integrated fixed-mobile operator. 4iG's acquisition cascade in the telecom market kicked off in 2021, by now narrowing the public telecommunications market down to 3 players.

In the banking sector, a partial portfolio swap has taken place in the region, with banks exiting markets that did not offer them economies of scale and looking for new acquisition targets in the region (Raiffeisen - Poland, Slovenia vs. Czech Republic, OTP - Slovakia vs. Slovenia). The acquisition merger transaction wave commencing in 2020 created the Hungarian Bankholding (abbreviated MBH), the second largest bank by balance sheet total in the Hungarian market.

Acquisitions can be made to improve cost efficiency, increase market share, or acquire a new capability or brand. The integrated telecommunications market in Hungary was created by the acquisition of new capabilities, which started with Telekom mergers in 2005 and continues with the 4iG acquisitions.

Once an acquisition deal is closed, integration is initiated, transforming business operations, functions and processes. The transformation of business operations entails the consolidation, and in some cases significant upgrade, of IT applications, infrastructure, and telecommunications network architecture.

The main phases of integration

Each integration project can be broken down into different, yet distinct, phases. The integration of people, operations and information requires significant technological investment, so IT has a major role to play.

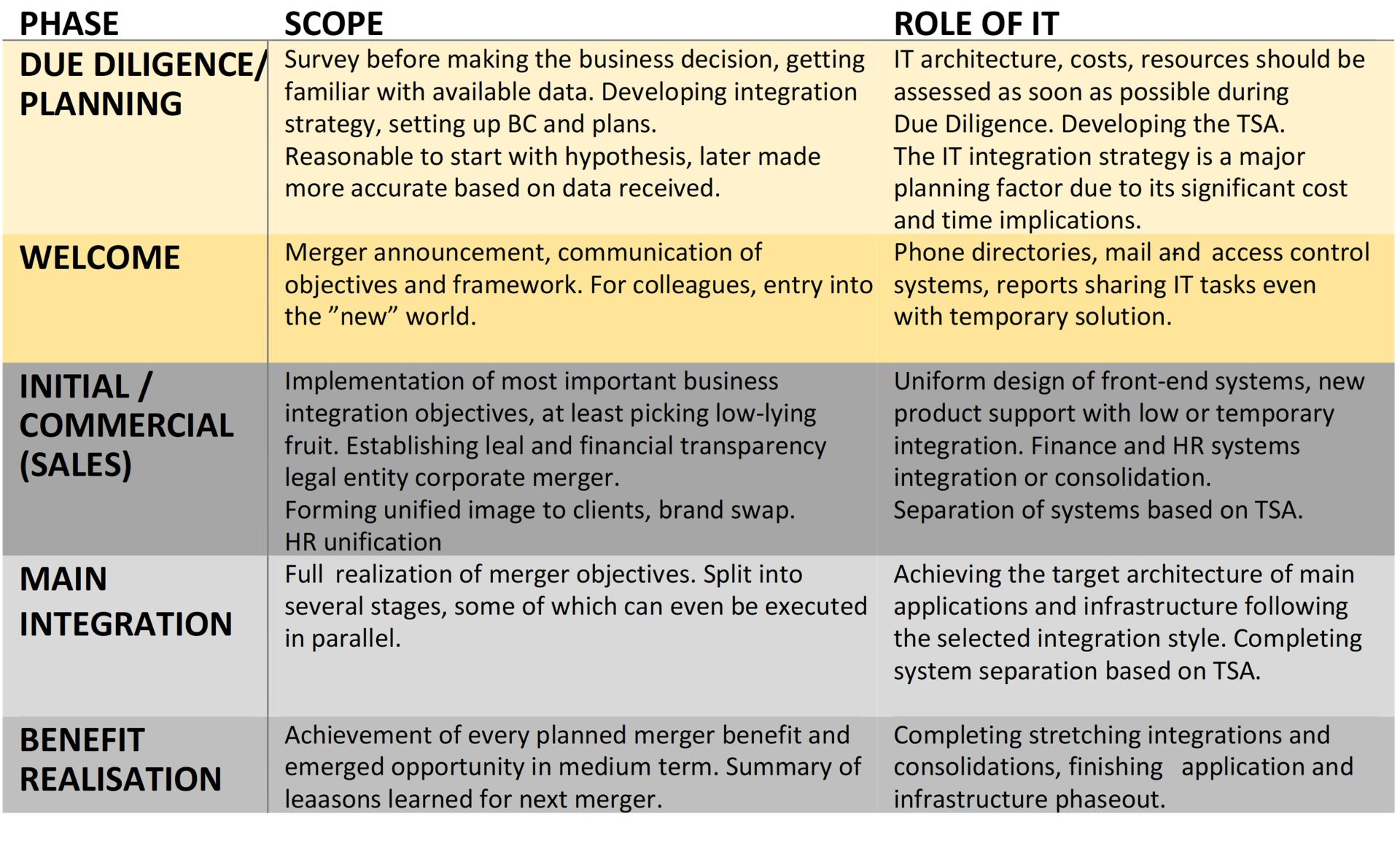

SCOPE OF PHASES AND THE ROLE OF IT

The corporate entity undergoing the merger may use many of the services from the earlier, old company group, so in the transition phase the services can still be provided by the old group. The contents of the Transition Service Agreement (TSA) are developed during the due diligence/ planning period, covering mainly IT, banking, telecom network services, and sometimes also encompassing business services.

Appropriate integration project organisation – Halfway to success

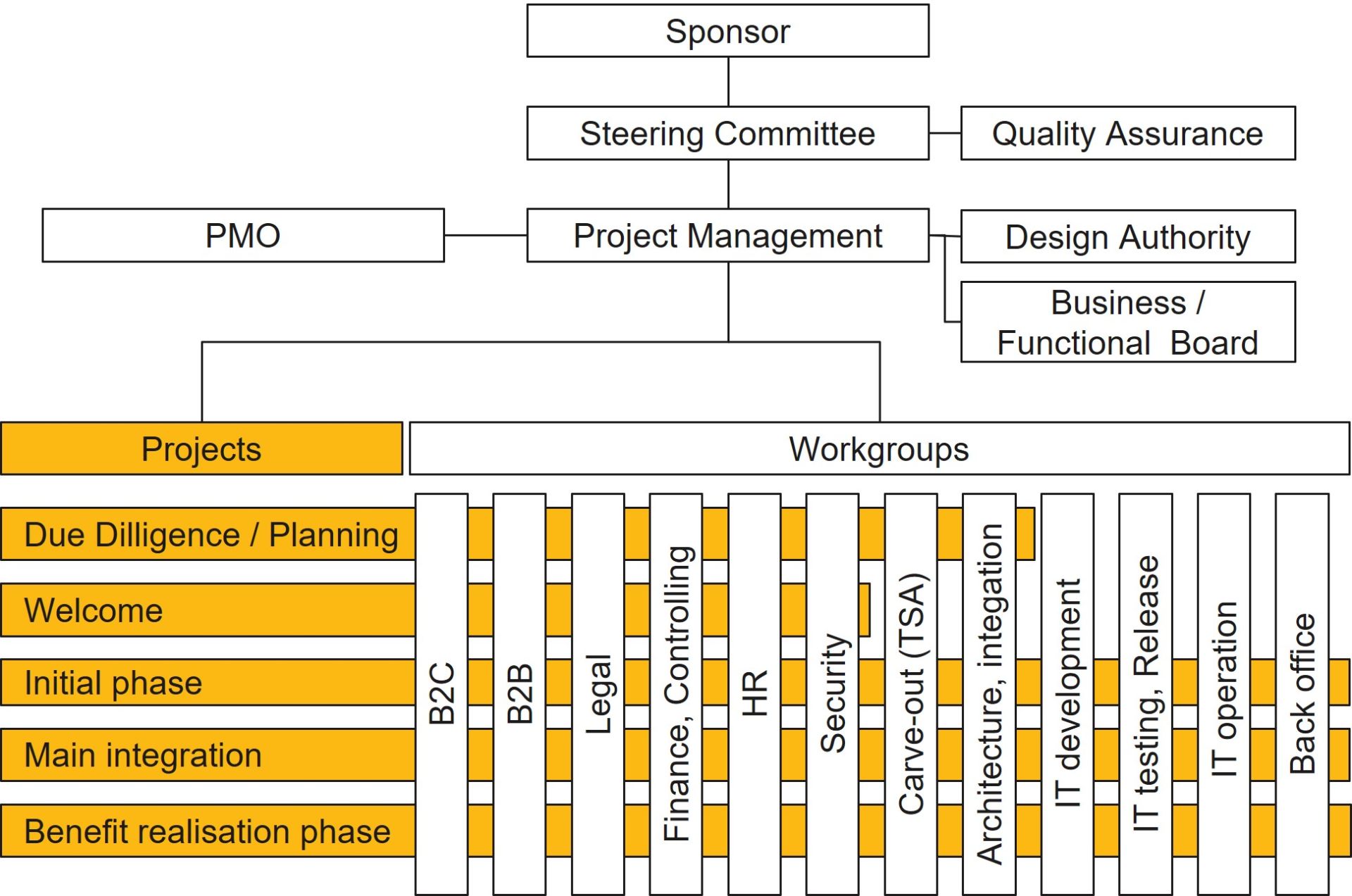

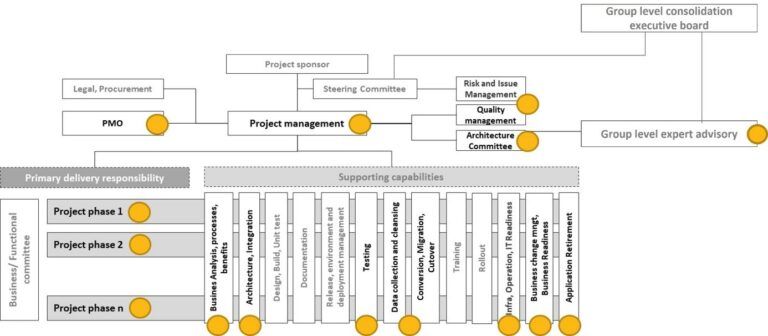

The implementation of the merger should be organised into a program (a set of projects). Even companies making acquisitions on a mass scale choose a project format for the initial and main integration phases.

The usual practice is to form 10-15 workgroups; the actual number may vary from phase to phase. It is important to find the right person to lead the workgroups. The position of workgroup leader creates a good opportunity to test candidates or further promote promising talents.

Business workgroups can be set up along business lines such as marketing, sales, customer service, back office, or banking. They can be based on customer segments (B2B, B2C), along the brand and its products, or even as a common intersection of these.

The legal, HR, finance, controlling, security, regulation and control areas are typically organised into separate workgroups.

The frame of IT workgroups reflects the IT structure: network, server infrastructure, office infrastructure, business applications, IT processes, operations, vendor management, and IT people.

It is recommended to arrange the business and IT areas around separate stand-alone workgroups or themes to form organised composite multifunctional workgroups. Caution is urged vis-à-vis introducing agile operations parallel to integration, unless the participants in the merger have specific agile operation-related experience.

Telecommunications network areas should also be organised in a separate workgroup.

If there exists a transition agreement (TSA), then according to best practices the former parent company under the TSA sets up a separate project to replace the services provided earlier. Their work is guided by the deadlines and scope set out in the TSA.

The Integration Project Office performs the conventional PMO functions, but must also ensure that business operations are not stalled due to the changes involved.

MERGER PROJECT ORGANISATION

Involving a wide range of the company staff may require the creation of several information or decision-making forums. Such bodies (e.g. Design Authority) can relieve the stress exerted on the Steering Committee (SC) by bringing the decision closer to implementation. In a complex, multi-tier project structure, care should be taken to keep the escalation path short.

Success criteria, pitfalls

The pitfalls of an integration project include the typical hurdles of business-technology projects. Some of the success criteria and obstacles typical of integration include, but are not limited to, the following:

Focus: Concentrate on the purpose of the merger and the business synergies, which are typically: new market entry, new product launch, or market expansion. When analysing the decision options and evaluating the results, consider how performance contributed to attaining the merger objective.

Culture: Identify the cultural gaps between companies and teams as early as possible, as these can be the worst hindrances of integration. Do not underestimate them! Avoid scapegoating cultural differences for everything that goes wrong during integration.

Planning: Plan integration in groups with teamwork. To solve complex problems, form cross-functional groups with broad, combined knowledge of several areas. Planning in silos initially yields results faster, but harmonisation, the preparation of the overall plan, eventually takes longer and produces poorer quality.

Carve-out: When negotiating the TSA, take stock of the worst scenarios and also those that account for incomplete documentation, the typical risks of technology projects. Involve an experienced consultant to help complete the TSA. We recommend that the TSA, under reasonable conditions, should include extension options.

Style: When choosing the style of integration, be careful and circumspect. In line with past trends, integration should be completed as quickly as possible, overcoming resistance. Groups with specialist knowledge, technology orientation, or innovative culture can be sadly destroyed with rapid integration.

Stowaways: Integration projects present an attractive, tempting opportunity to replace existing, often obsolete applications, infrastructural, or network elements. Think carefully about this risk factor and the expected benefits. If there appears to be no profitable business case coinciding with the objective of the merger, then ponder whether the new element of the investment can be postponed until the last phase of the integration or post-integration.

Underestimation of collective knowledge, complexity: We often take into account the complexity of business processes, functions and IT systems, but overlook the fact that these can only be truly grasped in the collective knowledge of employees, and therefore drawing up plans and requirements and actual implementation may take a considerably longer time period.

How can Stratis help with mergers?

Stratis Ltd. is the largest Hungarian-owned, independent management consulting company with more than 20 years of experience and an annual revenue exceeding HUF 3 billion. We have a proven track record of key competencies in the operational due diligence, evaluation, risk/hazard assessment, integration and consolidation project planning & design, execution, and IT strategy development for companies in the banking, telecom and energy sectors.

In the energy sector, we have fully and comprehensively participated in mergers, where e.g. we assisted the split of a single company and the integration of the resulting parts into two others. Our roles included merger planning, due diligence, TSA design, carve-out and integration project execution.

In the telecommunications market, we have carried out due diligence tasks in several mergers. We have experience in the telecom sector in TSA design and carve-out project execution. We also have extensive experience in the consolidation of telecom applications.

We hold the consulting competencies required for data cleaning and migration; with our Analytics business, we can implement them in practice. We had accomplished this before in both the telecom and banking sectors.

STRATIS CAPABILITIES IN PROJECTS RUNNING IN THE "INITIAL INTEGRATION", "MAIN INTEGRATION" AND "BENEFITS REALISATION" PHASES

About author

László has been working in IT management for 17 years. In the past years he has worked in the evaluation of acquisitions and IT integrations. He has been involved in the consolidation and replacement of telecommunications and banking core systems. His experience as an IT manager, consultant and quality assurance manager has been used in the preparation of this study.